Have you ever wanted to buy an iPhone as easily as groceries? Now, compare that iPhone to a huge financial investment like a house, or better yet, a ‘dream home’. Didn’t the amount multiply significantly?

After you’ve decided which iPhone model you want, the next step would be whether you can spend a huge amount in a go to purchase it.

The concept of Equated Monthly Instalment (EMI) helps you divide a big expense into tiny expenses over a specific period.

Similarly, there’s a crucial step after you’ve decided on the “model” of your dream home. It is the step that takes you closer to owning your dream home – The Home Loan.

A house is a huge financial investment. To fulfill your dream to buy a home, the loan is, in most cases, an unavoidable step. The EMIs that you pay for the house, are mini-installments to pay back the lump sum home loan amount.

We want to ensure that you don’t choose a home loan that might look great at first but later becomes heavy on the wallet. Here comes the home loan eligibility criteria that play a key role in determining your home loan EMI.

Let’s see how.

What is Home Loan Eligibility?

Simply put, it is the criteria that the lender considers ensuring you pay back the lump sum amount on time.

For example, you’re buying a high-end car and paying a monthly EMI for approximately six months. This amount was arrived at with the help of a car loan EMI calculator.

But, to get your dream home, you’d have to pay this Home Loan EMI for a maximum tenure of almost thirty years.

Even the lowest tenure of a home loan goes on for five years. It’s precisely why calculating your home loan eligibility criteria is crucial.

Because the more eligible you are, the lesser the interest you have to pay. Remember, the home loan tenure includes many years even after you’re living in your dream home. The home loan eligibility calculator is technical in approach and considers numerical data. But, the home loan eligibility criteria are more tangible points that can help you get a lesser home loan EMI.

What are these factors that determine your Home Loan Eligibility Criteria?

Your current age

The younger you are, the more likely you are to clear your loan with the interest on time. Why is that? Well, simple logic. The younger you are, the farther you are away from retirement.

This makes you and your partner more eligible to pay off the home loan on time. The same logic stands true for an individual who is closer to retirement and pays a bigger Home EMI plus interest on the home loan.

Your financial stability

Like how every one of you wishes to have the home of your dreams, each borrower who goes to the lender has a different financial situation.

These financial institutions are extra careful to ensure that they get the borrower returns this lump sum home loan amount on time. They consider various factors like age, annual income, stability of income, etc. to get a clear understanding. This is one of the numerical factors, like monthly income, that is a key factor in calculating your home loan EMI.

Your credit history and scores

Do you recollect how back in college, your assignments would get fewer marks if you submitted them after the deadline?

Your credit score is literally the “marks” you get for paying back your debt on time. The more time you take to ‘submit’ your debt amount, the less credit score you get.

Credit history is how diligently you submitted all your previous debt “assignments”. No borrower wants to take the risk of giving a huge home loan at an affordable home loan EMI rate when you score well only in one exam!

If you have any existing financial liabilities

Liability in simple terms is an existing financial burden. For example, a car loan EMI that you’d have to pay along with your home loan EMI.

Clearly, if there’s already a big payment you’re making, the Home Loan EMI is bound to become another huge liability. The lender wants to make sure that you don’t miss out on the home loan payment! Similar to the concept of BNPL, you can’t have too many liabilities that lower your points on the EMI calculator.

Your personal profile

A profile in the finance world is additional personal information about you to have a better understanding of you. For example, you might not have an existing financial liability like a car loan, but you might have an elderly family member who depends on your income. This is another added factor that increases both, the risk to the home loan financier, and invariably the home loan EMI.

At Vittae, we learn about you in the very first step that helps our Financial experts to give you a personalized financial plan. Our finance experts give you advice that’s both professional and personalized, on matters like these.

Your dream home factor

What makes a dream home dreamy? Prime location, quality amenities, and everything that you’ve always dreamed would be a part of your own home.

All these factors also play a role in determining the cost of the home of your dreams. The bigger this dream is, the costlier it gets.

But the interest you pay on your home loan doesn’t have to be that costly too. Making a smart choice about buying the right home is important.

We also give you expert advice when making these long-term investments.

How to calculate the Home Loan EMI?

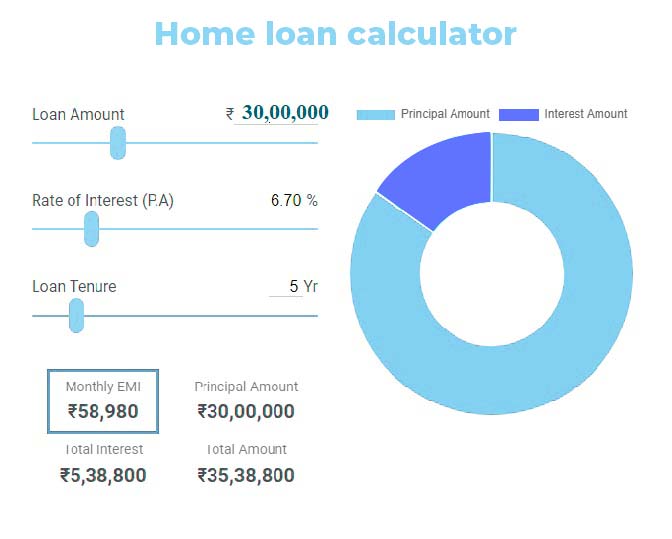

The tool used by any financial institution is a Home Loan EMI calculator. It considers all the metrics to calculate how much money you’ll be spending every month on your housing loan. This helps you get a clear picture of how the amount was derived, and plan for the future.

The below image will give you a clear understanding of the parameters the home loan calculator considers while calculating your home loan EMI.

Here are 5 easy tips to increase your home loan eligibility

- Having a co-applicant helps the process

When you include your spouse or an earning family member as a co-applicant, your credibility increases. You are more likely to pay off the home loan faster with a dual income and avail greater tax benefits.

- Ensure you have a good credit score

The credit score is a strong metric for calculating your home loan EMI. Having a higher credit score boosts your eligibility and helps give you a lower EMI. It’s no rocket science how you can do this. All you have to do is pay back your debts on time, consistently. You can’t trick the home loan eligibility calculator with a bad credit score and hope for a less home loan EMI.

- Be diligent about repaying any existing debts

It is only natural for a household to have existing loans or debts. These debts can be existing loans like car loans or monthly installments like washing machine EMI.

This helps you not only manage your expenses but also gives a higher credibility. Repaying debts is also a subset of the BNPL mindset that helps you buy costly necessities like a car at an affordable EMI, like a car loan EMI. Remind yourself about the upcoming home loan EMI and that should help!

- Pick a longer tenure to help you

It’s a common misconception that having a longer tenure will be like a longer burden to pay off the home loan. But it’s simple math that a longer tenure means lower interest for you and less risk for the lender.

It’s okay to choose a longer tenure. This gives you the assurance that the extra number of years help you count the home loan EMI as a recurring expense and not a burden. But that doesn’t mean you apply this on other payments like a car loan EMI and drag it forward. Pay off what you can, at the right time.

- Update about any additional income sources

Having an additional source of income adds a lot more weight to upgrade your home loan eligibility criteria, and gives you an affordable home loan EMI.

It’s a given that any amount of additional flow of money like rental income increases your payment capacity and invariably gives you a better home loan.

These above-mentioned factors revolving around your finance management, are simple tips that will help you immensely when you make a big decision like buying a new home, or better, celebrating a beginning.

But, given the chance to buy your dream home at a low home EMI, wouldn’t you grab the first deal you get?

Well, that’s the ‘buy now pay later’ (BNPL) mindset, that’s playing tricks on you.

And, we want to ensure that you don’t fall prey to this BNPL mindset and choose the wrong loan. Essentially a wrong loan is not a bad choice, it’s not cost-effective considering the long number of years you have to pay off the home loan.

The ‘BNPL’ concept lets you shop, check out, choose a BNPL player, and then pay later. This allows the BNPL financier to pay on behalf of the customer. It’s as if the customer took a mini-loan for the purchase and can return the amount with zero interest, in most cases. This further affects their credit score too.

Quick online purchases let you add items to a cart at the click of a button or a tap on the screen. But, buying a house is a long-term investment that should not be made hastily.

We can attest that every rupee saved, is a rupee that can be invested, and grown.

Understanding these simple metrics helps you, as the borrower, get the most optimum home loan for you. Furthermore, these tips to improve your home loan eligibility criteria will make the drawn-out home loan EMI payments easier on the pocket.

Our Financial experts are both aware of the intricacies of the home loan process, and the current market conditions, to help you make the best choice for you.

Buying your own home is not a long-term investment but more importantly a memorable milestone. It’s often not a singular decision, but a collective call taken by a family who wants to own their dream home.

The home loan application process, with the home EMI calculation, and on top of that, the monthly payments (with interest) can be mentally taxing. We want your dream home to be more about your dream come true, than a home loan that feels like a burden.

With Vittae, you can understand, learn and make an informed decision. We enable you to grow financially and also help take tough financial decisions like these. Our experts will ensure that you don’t follow the herd mentality, but take a call that’s personalized to you, truly. You are only one step away from making the right decision for you, and your dream home.